The medical electronics industry does not currently fall under the scope of the European Union (EU) reduction of hazardous substances (RoHS) directive (2002/95/EC). Medical electronics are not expected to be included in the scope of the RoHS directive until the next revision of the directive (2010+). So, why are medical electronics executives converting their medical electronics products to be RoHS compliant?

It may not be public knowledge, but if you speak with electronics component suppliers, most would agree the process of conversion to RoHS compliance is underway for most medical electronics companies.

All of the principle electronic component suppliers have received numerous requests for RoHS-compliant replacement components, at least as part of a gap analysis, from most of the principle medical electronics producers in the US, if not internationally. Why?

There are five (5) key factors driving the process of RoHS conversion of mainstream products for medical companies. All five (5) factors are finance-driven, as opposed to a general trend towards green.

Green medical electronics is a ‘nice concept’, but multi-million dollar product conversions and re-qualification projects are not generally financed at the behest of a ‘nice concept.’

The five (5) principle factors are:

- Part obsolescence and end-of-life (EOL) management

- Product cost management

- Long design iteration and regulatory approval cycles for medical products

- Competitive pressures

- New technologies

Part obsolescence and end-of-life management

Arguably, the most pressing factor diving medical electronics executives toward RoHS conversion is the supply chain issue caused by the conversion to RoHS compliance by the electronics industry, in general.

RELATED DOCUMENTS

Contract Agreement for EMS Medical Device Design Services (7 pages)

Contract Agreement for EMS Medical Device Manufacturing Services (14 pages)

OEM RFQ Terms & Strategy Clauses Presented to EMS Provider

OEM Terms & Strategy for Program Transfer to EMS Factory

Contract Agreement for EMS Electronics Design Services (7 pages)

Many medical electronics executives and their electronics manufacturing services (EMS) providers, or contract manufacturers, see three (3) principle impacts from this conversion:

Component supply issues

A lot of manufacturing lines are experiencing delays or production stoppage due to component shortages or extended component lead times.

Part obsolescence

Many electronics component suppliers are not finding it financially viable to maintain two streams of components (Pb and Pb-free) and are therefore consolidating production lines to higher volume lead-free components. This consolidation is leading to a significant upswing in part obsolescence and supply chain / engineering effort for medical products.

Inventory costs

One way to manage part obsolescence is the concept of a large, last-time ‘buy’. The cost of last-time buys are often made on ‘crystal ball’ sales projections and may add a significant expense that is never recovered. The recovery of this expense is even more nebulous, as non RoHS-compliant parts that are purchased as last-time buys may become excess inventory once the product itself is converted to RoHS compliance in two to three years.

For many medical electronics executives, the cost for RoHS assessment of their current products can be validated financially based on the cost savings from a review of their expected rate of part obsolescence conducted in parallel with the RoHS product assessment and gap analysis.

Product cost management

Since high-volume, low-cost electronics production is by necessity becoming Pb-free, costs for non RoHS-compliant products are generally rising. These rising costs impact product margins for many medical electronics executives and are expected to rise over the next couple of years as the pressure to convert manufacturing lines to single RoHS-compliant lines increases.

Long design iteration and regulatory approval cycles for medical products

Medical electronics, depending on their application, are often non-trivial to re-design and have long reliability testing and regulatory approval cycles. Re-design and product approvals can take years and can extend significantly longer than originally planned. To allow for long re-design, re-qualification, and regulatory approval lead times, medical product executives need to begin the re-design process years in advance to prevent a potential sales gap.

Competitive pressures

Medical electronics executives who unveil RoHS-compliant products, while maintaining performance and safety characteristics, will have an advantage not only from a marketing standpoint, but just as likely from a cost standpoint (due to the rising costs of non RoHS-compliant products). This advantage is expected to extend from a corporate marketing advantage to an institutional procurement requirement as government and hospital organizations are increasingly adding ‘green procurement’ requirements to equipment procurement specifications.

If RoHS compliance becomes a purchasing requirement for major institutions, then producers without RoHS-compliant versions of their products will be at a disadvantage. This is particularly common for publicly funded organizations and institutions.

A real-world example of this is the Electronics Product Environmental Assessment Tool (EPEAT) procurement specification for computers in the US. The US government and other major institutions (including many hospitals) have embraced this procurement standard and exclusively offer tenders to computer producers of EPEAT-certified products. The EPEAT standard includes RoHS compliance as a requirement.

Medical institutions, especially in the EU, are reviewing materials notifications and restrictions as a requirement for tenders when procuring new medical electronics. An example is a recent recommendation to the Karolinska Hospital, located in Sweden, for procurement of medical electronics:

Electronics: The tendering supplier must / ought to be able to state the content of all flame retardants. State the total content of halogenated flame retardants1 in grams for the product or products

New technologies

Many of the newest electronics technologies, such as high density FPGA chips and high density memory, are being produced solely Pb-free. Products or product sub-assemblies that have not converted are not able to take advantage of the performance and cost advantages offered by these new technologies.

In summary, RoHS conversion of medical electronics products is being driven largely by finance-related factors and not only legislative concerns. With the long re-design and re-qualification cycles for medical products, the risks related to non-conversion mount.

On a final note, here is some advice based on my experience with RoHS conversion of mainstream medical electronics: Do not delay the RoHS gap analysis of current projects; the part obsolescence review itself will pay for the gap analysis. More delays will be related to disagreements on funding and project management between business lines in the same company than from the product re-design itself.

Additionally, executives should not neglect mechanical and electro-mechanical components. Medical electronics manufacturers are experiencing more conversion headaches from pumps; enclosures, and gears than from the conversion of printed circuit boards.

(1) In addition to lead (Pb), RoHS also places restrictions on the content of polybrominated flame retardants (PBB & PBDE), hexavalent chromium, mercury, and cadmium in electronic products.

Medical Electronics New Product Launch and NPI Management in EMS Manufacturing

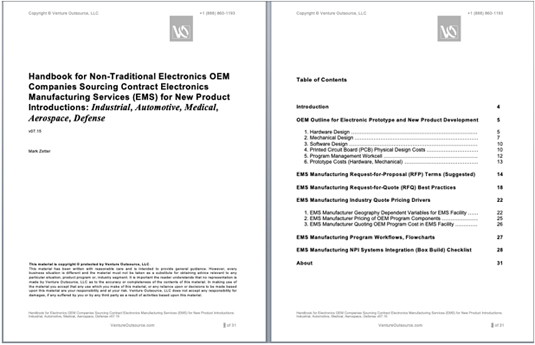

Learn more about medical electronics new product NPI program launch and cost management with the Venture Outsource 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide medical electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.