The materials cost of goods sold (MCOGs) is between 75 percent and 85 percent for the average electronics product. There’s no doubt best practices in procurement and tight inventory turns helps electronics hardware companies compete in the marketplace, especially with launching non-unique devices (think: white box ODM cloud servers) where price and features/functionality drive purchase decisions over brand awareness.

No doubt, effective enterprise resource planning (ERP) is important.

Below I highlight some industry best practices for specific materials-focused functional groups within EMS providers, along with key responsibilities (and some of the challenges these groups face), which can have a direct impact on effective materials management in a fast-paced outsourced electronics manufacturing environment.

Procurement and materials management performed by an EMS provider is different from purchasing and managing components performed by most process-intensive OEMs. To highlight this difference, let’s compare an EMS provider to, say, a chemical manufacturer.

It’s not uncommon for providers to source 2,000 different components to produce 500 printed circuit board assemblies. Whereas, the chemical manufacturer may source only six to ten elements to produce hundreds, or even thousands, of different chemicals. There is a big difference in the number of required components v. elements.

Let’s look at the triggers in the EMS provider that helps drive the sourcing decisions and related activities enabling providers to produce those 500 PCB assemblies. (Read: How to drive costs out of your EMS manufacturing program)

The EMS provider team is made of the following personnel and site functions, including; a master scheduler, planning, materials and component buyers in the purchasing department; warehouse receiving; stock room, backflushing / kitting, cycle counting, a materials review board (MRB) and materials scrapping. (See also: Tips and articles about planning and purchasing strategy)

Examining some of the responsibilities above help form a wider scope of understanding how various materials-based groups work together to move an OEM’s program through this portion of the supply chain. (Providers: Submit your company in our EMS Resources Directory Marketplace)

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

The master scheduler

Incoming (arrival of) the OEM customer order is considered the de-coupling point for active materials management in the scope of the greater OEM-EMS relationship.

EMS providers, in turn, use materials requirements from OEM orders as the tipping point that nudges the EMS provider master scheduler into action.

Some questions the master scheduler needs answers to include: Where do I start ‘pushing’ materials and, where do I start ‘pulling’ materials?

Where:

Pushing = Inputting the OEM forecast to drive [OEM] material requirements

Pulling = Putting in the purchase order (PO) to drive EMS material responsibility while minimizing business and materials risk at the provider.

To understand the role of the EMS provider master schedule, see below for purchase order demand being placed into the system.

Role of the EMS buyer

EMS buyers then make commitments to the OEM program’s supply chain. Some questions EMS buyers need answers to include: What do I run the risk on (when buying) and, what do I have actual purchase orders in-hand against?

This is where the approved vendors list (AVL) comes into play. In larger, vertically integrated EMS providers the supply chain management team may put together the AVL. Whereas, in smaller providers the customer usually puts together the AVL (mainly because there is little to no reward for small EMS providers to put in this type of effort)

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Purchasing and the role of procurement in EMS providers

EMS purchasing then places the materials orders in-line with enterprise resources planning (ERP) and works against the desired quantity of materials needed, along with the dates and other deliverables required.

SEE ALSO

Best practices for EMS manufacturing RFQ quotes

EMS Manufacturer internal cost vs OEM quoted fees vs OEM target price

Receiving (warehouse)

The EMS warehouse manages its own set of books (receiving and recording) on items received. The warehouse typically targets full completion of receiving transactions within 24 hours of the materials’ arrival. But as with a lot of things in life, things can go wrong.

To help manage this, receiving must work to actively manage an area in the warehouse that some providers refer to as the ‘challenge shelf’’, a specified warehouse location, typically a shelf, where materials with unresolved issue(s) are stored, such as:

- No PO in the system

- Part number (P/N) does not match PO

- Greater quantity v. quantity identified on the packing slip

The ‘receiving inspection’ function (reports to quality) and therefore creates a checks and balances system, checks incoming materials form factors and visual Inspection. ‘Receiving’ vs ‘receiving inspection’ should be viewed differently. The two functions have two distinct materials management / inspection teams. EMS receiving (warehouse) holds the responsibility of internal materials inspection whereas the quality department holds external materials management responsibility.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Its important to note that with both teams in place it’s the EMS buyer’s responsibility to root cause issues and drive resolution for items on the challenge shelf. The EMS buyer’s responsibility ends the moment material is entered into the ERP system.

Once in the ERP system, the external materials team’s responsibility takes over and the ‘planning’ takes responsibility of the materials.

Warehouse stockroom

The stockroom (warehouse) carries responsibility for helping feed production the materials based on driving lean kanbans and other supplier replenishment programs…

EMS Planning

EMS planning remains active throughout all of this…running parts ‘shortage reports’ to determine quantity on-hand to run kits vs. quantity needed to run kits. Shortages are worked through with the purchasing department. Many providers empower their buyers to call suppliers. This is a good practice and can help drive OEM satisfaction.

Savvy EMS providers learn how to staff their planners strategically, knowing planners with certain experience are better suited for particular sourcing or product mix responsibilities.

Below are common parts v. relative planner or buyer experience, and combinations thereof, often targeted when staffing EMS planning departments:

Product mix with desired experience

1. Product with high number components: A planner with purchasing experience is ideal

2. Sheet metal, plastics enclosures: A buyer with planning experience

3. High-cost ASICS: Best to have separate planners and separate buyers

While all of this is occurring EMS program management is busy committing or commenting back to the customer because nobody likes surprises.

EMS Provider backflushing, kitting

EMS planners are responsible for ensuring product manufacturing orders are fulfilled for production and for closing-out customer orders in the system. Backflushing determines any parts / components / materials needing to be subtracted from inventory on record.

The inventory corrections process is driven by any number of parts taken out of inventory and delivered to production against the number of parts required in order to match the OEM product BOM already used in manufacturing. When kitting is performed properly and manufacturing uses full demand there is no need to backflush. Where backflushing does take place managing an accurate process is important.

Deciding when a production order is complete can be a bone of contention among EMS provider internal departments.

Another gray area for some EMS providers is deciding who ultimately is responsible for acknowledging the transaction in the system. Example, if 4,997 out of 5,000 OEM product are built in production, does EMS planning scrap-off the remaining balance of three?

EMS Warehouse operations

When MCOGs can be in excess of 80 percent for some electronics product, inventory cycle counting become even more important. Provider warehousing can be divided into four key areas: main warehouse, MRB, receiving, and finished goods inventory (FGI). These locations need clear cycle counting management guidelines.*

The following guidelines are just some of the common industry practices among EMS providers for effectively managing warehouse parts inventory by location:

Warehouse locations and cycle counting frequency

- Main warehouse (see below)*

- MRB should have a physical count 1x / week

- Receiving should have a physical count 1x / week

- Finished goods inventory (FGI) should have a physical count 1x / week

Because the EMS provider’s main warehouse location houses both components and parts of varying degrees of value (e.g., $ cost) successful measuring and control metrics/programs are put in place that can help warehouse and materials management obtain greater granular visibility into materials movement.

In your search results, you will be able to further target provider options by choosing End Markets and/or other Services.

It’s common practice for EMS provider inventory to be cycle counted differently based on inventory quantity and value. Managing inventory in three distinct ways can help considerably. To explain one example, these can include dividing inventory quantity into A parts, B parts and C Parts, where:

- A Parts = approx. 5% of inventory but equal 80% of warehouse value

- B Parts = approx. 10% of quantity and account for 15% of value

- C Parts = approx. 85% of quantity and account for 5% of value

*Main warehouse cycle counting (parts)

A = 1x per month

B = 1x per quarter

C = 1x per year

EMS Provider materials review board (MRB)

Provider MRB and MRB management is becoming increasingly important in industry and its not uncommon to see industry job postings for MRB engineers with experience in manufacturing processes and quality management.

The objective for most materials in an EMS providers MRB area is to make a decision on the materials within one week of entry. What really takes place in most EMS environments is, on average, three weeks, and often times much longer. Materials disposition solutions will also involve input from numerous departments (engineering, quality, planning…)

It’s probably safe to state that every EMS provider would like to keep scrap at zero percent of throughputs. Most EMS providers target one percent scrap as acceptable. But, even this target gets expensive. Only limited provider personnel are typically designated to ‘sign-off’ on inventory when scrapping material.

A clear procedure for this is always on file in ‘document control’. One question electronics OEMs and EMS providers must ask themselves; Is scrap incorporated into the customer BOM to account for failure, damage, etc…?

Career development

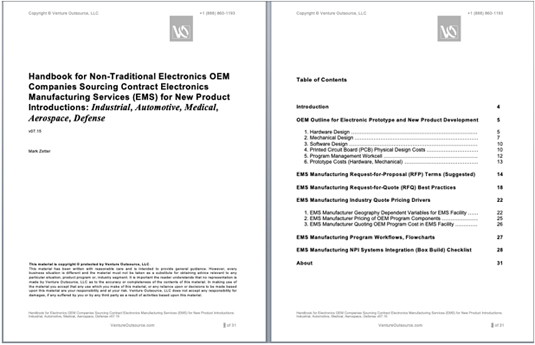

For electronics OEM buyers and planners wanting to learn more about new product NPI program launch and management to better understand OEM sourcing of EMS services and the role of OEM-EMS program management, consider our 30-page handbook you can request here or below.

Our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook is titled for non-traditional market sectors but it also applies to other electronics industries and can help guide OEM equipment manufacturers when formulating and benchmarking their new product launch roadmap and strategy. Request this handbook.