First joint venture between a notebook OEM and an ODM. Previously, ODMs only set up vertical integration joint ventures. Compal could make less profit from the deal than others think. What impact will the joint venture have on other ODMs?

Original design manufacturer (ODM) Compal Electronics is a leading notebook manufacturer. Shipments have grown rapidly in recent years, reaching 48 million units in 2010, accounting for 25% of global market share for the notebook market.

Compal is also active in the LCD-TV sector, shipping around 4.5 million units in 2010.

Compal’s primary main production facility located in Kunshan, China, with 2010 monthly capacity of 6.5 million units according to a report published earlier by investment bank KGI.

Compal recently announced a joint venture with China’s Lenovo to manufacture personal computers including notebooks, AIO (all-in-one) and related components.

This marks the first joint venture between a notebook OEM and an ODM.

In the past, notebook ODMs were only setting up joint ventures with component makers for vertical integration, such as Compal’s previous joint venture with Ju Teng International Holdings. (www.juteng.com.hk)

The new joint venture is named Lienpal (Hefei) Ltd., is requiring a total investment of US$100 million, of which Compal is committing 49%, or US$49 million.

Lienpal (Hefei) Ltd., is scheduled to start mass production at the end of 2012.

In your search results you can further target Services, End Market(s), then select Go.

What’s in it for Compal?

Compal says the joint venture with Lenovo will help strengthen customer relationships; enhance logistics efficiency, and improve compositeness in view of the strong growth in IT demand in China combined with the Compal’s customers’ significant strategic plans in China.

The KGI report states Compal plans to develop notebook-related product capacity of 5 million to 10 million units annually for the Lienpal factory in 2013.

The factory will be located in Hefei, Anhui, and will mainly support Lenovo’s original in-house manufacturing volume, which is around 20 to 30% of Lenovo’s total shipments, the report states.

Interestingly, when the new plant starts production, Compal will not consolidate sales but rather book the profit (or loss) on the investment side each quarter.

KGI writes it feels the joint venture will enhance Lenovo’s manufacturing efficiency and lower Lenovo’s product costs from previous in-house manufacturing given the leverage of Compal’s scale.

Meanwhile, some feel the venture could help Compal to move closer to Lenovo, possibly securing product volume growth in the coming year. But, more on this in a moment.

Many in the investment community feel Lenovo will be one of the major growth drivers for Compal, even though Lenovo does not incorporate shipments contribution from the newly-established factory, the report states. Instead, it is believed Compal will book any profit earned from Lienpal through a non-operating line.

One report states Compal’s top management suggests Compal could see around 20% year-on-year growth in 2012 notebook shipments, on top of flattish year-on-year growth in the notebook sector due to strong order growth from Dell, Lenovo and ASUSTeK, despite order declines from Acer and Toshiba.

KGIs report makes the assumption of 4 million to 5 million shipments increase from Dell, mainly transferring product volume from from Hon Hai, coupled with order increases from Lenovo and ASUSTeK by an additional 3 million to 2 million units, respectively, Compal’s 2012 shipments could rebound from around 40 million units in 2011 to 47 to 48 million units. KGI feels these three growing clients could comprise 55% to 60% of Compal’s total notebook shipments in 2012.

In your search results, you can further target provider options, then selecting Go.

The investment bank, in its report, also states it is of the opinion Lenovo’s share gains, given its leading position in China, and the solid China notebook demand growth should generate upside for Compal after the factory is set up.

Compal management has also noted the current supply chain near Kunshan should offer support for this new factory.

“We do not find Lenovo’s statement regarding the purpose of the joint venture with Compal convincing. We believe Lenovo is trying to squeeze more profit from ODMs, so it chose to form a joint venture rather than directly increase outsourcing to ODMs.”

However, potential risk in the factory joint venture as defined in an alternate report from Yuanta Research states Compal may make less profit through the total orders from Lenovo at both Compal and Lienpal’s facilities even with additional order gains from other ODMs.

Yuanta writes Compal could earn less profit from Lienpal than from its current China factories, unless Compal can get enough additional orders from Lenovo to feed Lienpal while not damaging original order volumes under Compal’s existing factories.

The Yuanta report also brings up the issue of single-client risk if Lenovo does allocate huge volumes to Compal.

Meanwhile, Yuanta sees there could be potential market share gain for Compal, at competing ODM Wistron’s expense, due to the Lienpal joint venture in the long run.

What’s Lenovo’s real purpose for a joint venture with Compal?

Lenovo claims, writes Yuanta, the main purpose of setting up the venture is to expand long-term capacity to support Lenovo’s business / revenue scale growth.

Instead of expanding a new facility by itself, Lenovo believes setting up the new facility through a joint venture with an ODM will help Lenovo develop better product innovation capability.

However, “We do not find Lenovo’s statement regarding the purpose of the joint venture with Compal convincing. We believe Lenovo is trying to squeeze more profit from ODMs, so it chose to form a joint venture rather than directly increase outsourcing to ODMs”, writes Yuanta.

What impact will the Compal-Lenovo joint venture have for other ODMs?

Contrary to assumption by many, including Compal, according to Yuanta, Lenovo highlighted the joint venture with Compal does not imply it will dedicate orders to a single ODM partner going forward.

Lenovo indicated it is open-minded about setting up other joint ventures with major ODMs if there is a need to set up new facilities in the future.

As mentioned previously, Compal says it decided to enter this particular joint venture for potential upside from Lenovo allocating more order to Compal’s 100%-owned facilities (where Compal can earn 100% of the profit) at the expense of other notebook ODMs. (Please see our list of the top 10 EMS / ODM companies ranked by revenue)

Yuanta’s research indicates Compal is already getting more than 40% order allocation from Lenovo in 2012, therefore Yuanta anticipates a low likelihood for Compal to win much higher allocation from Lenovo.

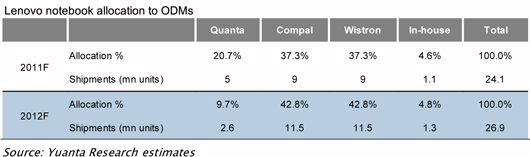

Lenovo notebook allocation to ODMs

What benefit can Compal gain with Lenovo?

Compal claims Lenovo will move most of its current in-house capacity to Lienpal, and thus the joint venture will have only a small impact on Compal’s current Lenovo orders manufactured in Compal’s Kunshan and Chengdu facilities, locations where Compal can earn 100% of the profit.

Yuanta writes: “We see potential risk that Compal may make less profit through its total orders from Lenovo at both its own and the Lienpal facilities, even with additional order gain at the expense of other ODMs. According to Lenovo, the Hefei plant is slated for 10 million unit capacity per year (which is around 37% of Lenovo’s total 2012F shipments).

However, Yuanta states in its report the bank believes Lenovo has only 5% in-house notebook shipments (1.2 million units) while Compal already enjoys 33% of Lenovo’s total shipments (8 million units) in 2011, and is skeptical Lenovo can feed the capacity of Lienpal only with its current in-house volumes.

Additionally, Yuanta does not expect Lenovo will provide better pricing to Lienpal than to other ODMs (including Compal), so Compal will likely make less profit from Lienpal because Compal needs to share 51% of the profit with Lenovo as part of the deal.

Lenovo says it will consolidate the profit from Lienpal into its operating line because it holds 51% share of the joint venture.

Lenovo also indicated it will lead the joint venture since 100% of the Lienpal factory’s output is for Lenovo.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.