Production-related activities in smart factories will need to be linked closer with administrative information systems such as enterprise resource planning (ERP) and manufacturing execution. Additionally, a broader range of sub-systems from various providers will need to be integrated into smart factories. (See: Various articles on cloud ERP and contract electronics)

The above predictions, plus the exchange of data, communications and manufacturing performance requirements are likely to become more complex for manufacturing and chief operating executives responsible for smart or connected factories, says a report produced late 2014 by investment bank UBS.

SEE ALSO

Tips for better RFQs

Understanding EMS quotes for electro-mechanical assembly services

Using RFQs to manage providers and materials costs

Ways EMS quotes influence should cost analysis

The report also conveys the belief computing or PC-based solutions will be utilized prominently as they become more standardized. Which, as a result, should enable different systems and products from different suppliers or integrators to communicate more effectively with each other.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Looking at industrial electronics and robotics plus, the connected applications and possibilities with the greater Internet of Things (IoT) and the role IoT-platforms will play in the automated transfer of data and connected factories, if electronics hardware and software of various systems are incompatible, the implementation of the smart factory concept may become even more complex than it is now and, thus, become more costly for embedded systems end users / customers. (See Webinar archives: Future of Computing: Pervasive Computing and the Internet of Things)

ERP, Manufacturing and Automation Optimization

Taiwanese strides in robotics and factory automation

Over the past 18 months, technology companies in Taiwan have been tapping resources to develop automation and robotic systems, or creating plans and roadmaps to expand into these areas.

In your search results, you can further target provider End Markets and/or Services.

UBS writes that part of the development process for industrial automation has been collaborative efforts between industrial PC and mechanical components suppliers, while major electronics manufacturing companies are supporting in-house automation and robotics divisions to increase their manufacturing efficiency and lower their production and operating costs.

Although robotics development in Taiwan remains behind countries like Japan and Germany, a 2014 survey by UBS shows Taiwan has a relatively complete robotics supply chain sitting on top of an already well-established electronics and mechanical industry.

Some major Taiwanese companies offering manufacturing printed circuit boards (PCB) and management of contract electronics developing manufacturing automation and robotics systems and components include:

Hiwin / Symtek Automation Asia: In Q314 the two companies collaborated and launched six axis robotics used in PCB manufacturing, helping manufacturers save space and labor costs.

Foxconn (Hon Hai): In November 2014, invested in Hon Qing Machinery located in AnQing City (Anhui Province, China) to develop and manufacture CNC machines and robotics.

Delta Electronics: Demonstrated own developed a selective compliance assembly robot arm’ (SCARA) using its visual recognition system during the China Industrial International Fair November of 2014.

Cheng Uei Precision Industry: After obtaining robotics technical know-how from Taiwan ITRI, the Company installed 35 robotic arms in Donguan, China.

In your search results, you will be able to further target provider options by End Markets and/or Services.

Robotics manufacturing advantage?

Analysts at UBS feel Taiwanese vendors could have a long-term advantage supplying robotics to the electronics manufacturing sector. One noteworthy fact supporting this thinking is Taiwanese companies rank among the world’s largest manufacturers of electronics goods. For example, Foxconn, Pegatron and Wistron manufacture all iPhones, while Taiwanese manufacturers also manufacture 80% of the world’s laptops and notebook PCs.

These high market shares for these particular electronics products combined with the concentrations in electronics by Taiwanese companies also brings other advantages.

For one, some factory automation robotics developers are also users.

Such will be the case with companies like Foxconn, Delta and Cheng Uei who have announced intentions to develop robotics for internal use and, may also look to sell robotics externally in the long run.

Will we see electronics services companies like Jabil, Sanmina, Plexus or Celestica purchasing robotics from Foxconn much like in 2000 when competing contract electronics manufacturing firms continued to purchase printed circuit boards from Sanmina (then called Sanmina-SCI) following Sanmina-SCI’s $1.3 billion acquisition of PCB producer Hadco?

Nonetheless, the general thinking regarding Taiwanese industrial electronics computing companies is these companies have gained vast experience in robotics after using automation equipment in their factories for many years. Thus, another advantage for the Taiwanese robotics industry in the long run.

Industrial Electronics New Product Launch and NPI Management

Learn more about industrial electronics new product NPI program launch and cost management with the Venture Outsource 30-page handbook you can request here.

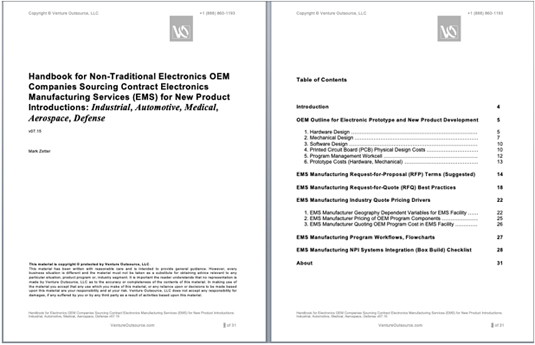

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide industrial electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.