“My electronics manufacturing solutions provider just sold me a bill of goods, conveying their manufacturing supply chain capabilities and framing the narrative with “superior supply chain predictability, agility, and visibility”. This is how EMS provider Sanmina positions their manufacturing execution system (MES).

“My electronics manufacturing solutions provider just sold me a bill of goods, conveying their manufacturing supply chain capabilities and framing the narrative with “superior supply chain predictability, agility, and visibility”. This is how EMS provider Sanmina positions their manufacturing execution system (MES).

Let’s say I’m CEO of a publicly traded electronics OEM company and I ask Sanmina: How does MES benefit me?

Contract electronics provider Sanmina has written previously, “Supply chain visibility is enhanced by artificial intelligence systems, advanced analytics, cloud-based systems and automated integration across the shop floor.” Sanmina’s article also claims Sanmina’s MES built internally saves $50,000 per week by minimizing components shortages.

Does Sanmina’s MES and superior supply chain predictability, agility, and visibility only yield results when ‘enhanced by artificial intelligence systems, advanced analytics, cloud-based systems and automated integration across the shop floor’, as they mention?

No EMS provider today has yet to achieve real manufacturing automation, and no EMS provider is currently using artificial intelligence (A.I.). Plus, MES and A.I. are not related, even though in the not too distant future I can see where A.I. and MES will coexist in some hybrid IoT/robotics/MRP/ERP franken-system.

In writing this article I did a market study on MES solutions in the marketplace today. In addition to 42Q (Sanmina’s MES solution), other MES vendors in no particular order also wanting you to think A.I. when reading about them include; Dassault Systemes (Apriso); GE Digital, ABB, Rockwell Automation, SAP, Oracle, Siemens, Plex Systems, Cogiscan, Epicor, Honeywell Process Solutions, Mentor Graphics, Aegis, and Schneider Electric, just to name a few.

None of these vendors offer A.I. capability, yet MES vendor marketers continue to carefully plant keywords in blog posts and articles, or write that their MES offering “allows customers to embrace A.I.” (Epicor). Or, MES vendors inform prospects and customers they invested in an innovation fund focusing on A.I. (Rockwell Automation).

Others, like SAP, offer what they label as ‘manufacturing intelligence’, which serves only as a hub between SAP’s ERP and MES, but SAP also does not have artificial intelligence.

I’ve worked in the contract electronics industry nearly 20 years and one theme I find constantly surfacing is there is little to no real, innovative, critical thinking among EMS leadership.

SEE ALSO

How to build costing modelers for contract manufacturing pricing negotiations

How AI ETL fortifies EMS manufacturing programs

I reached out to Sanmina’s technical author, wanting to learn more about Sanmina’s MES and details about the $50,000 per week savings the writer claimed. Sanmina is the only MES vendor I found who write/talk about their MES, claiming a specific dollar amount saved.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

But the reply I got contained only marketing speak accompanied by some tomfoolery. The article claiming $50,000 savings was removed from their site revealing a 404 page. (UPDATE: Sanmina re-published their article)

Not to pick on Sanmina, many EMS providers often make claims when promoting or selling their solutions, but on closer examination the capability-to-actuality ratio is not always what it appears – typical for EMS organizations who put out fires more often than they apply careful, thoughtful thinking toward solving complex problems.

(Mis)managing manufacturing

In Sanmina’s situation, unanswered questions I had lingered and center around which customer benefits are they actually selling with their MES?

What communications are happening between the 25,000+ pieces of equipment connected in the cloud a Sanmina press release recently claimed?

Does reflow talk to SMT pick and place? Do Sanmina screen printers talk with reflow ovens? Are Sanmina’s machines learning for optimizing configurations to remove waste? (Muda 無駄)

A lot of electronics equipment manufacturers are using legacy MES and that value has already been translated into the MCOGs. Again, none of these are using A.I., so far.

EMS providers with no clear & effective

strategy for lowering indirect labor costs

are mopping the floor with the faucet running.

Yet, Sanmina, and many other EMS providers, post keywords like artificial intelligence, A.I., and manufacturing automation on their websites even though none of their factories are self-operating.

MES is simply low-hanging fruit when it comes to cost reductions. Alone, MES savings are narrow in scope and marginal when compared to other manufacturing related costs, like those tied to workers in functional groups supporting the shop floor.

SEE ALSO

Unlocking BOM value comparing electronic design automation (EDA) tools

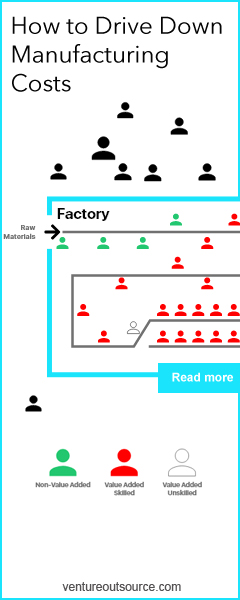

Sanmina’s MES is only addressing direct labor (DL), where the majority of savings has already been had post Six Sigma/lean implementation. Whereas real manufacturing cost savings is in efficient management of indirect labor (IDL). But managing IDL is difficult and requires real work.

Freeing up working capital in costly manufacturing supply chains

Savings opportunities attributed to lower IDL costs for any manufacturer, any EMS provider, will far eclipse savings focused only on DL.

Putting this in perspective, the average cost per hour for manufacturing DL is estimated at $23 (US). Contract electronics solutions companies like Flex, Jabil, Sanmina, and Celestica are paying IDL process engineers and manufacturing engineers US $60k to $80k, each year.

EMS buyers and planners can range from $50k to $60k per year, and higher for planning managers. EMS master schedulers command $100k+ and EMS provider purchasing managers and materials managers can earn $100k to $120k per year.

Program managers and program management directors can earn $130k to $150k, annually.

Compared to the impact MES can have (DL only), properly implemented A.I. goes much deeper into driving costly IDL worker accuracy, timeliness and productivity resulting in increasing manufacturing enterprise efficiency, freeing up massive amounts of working capital across a wider scope of higher priced IDL workers, including but not limited to, the following functional roles inside a small EMS factory:

I. EMS S,G&A: Document control manager. Documentation specialist, Documentation clerk, MIS support person, ISO Training

II. EMS Materials: Materials/supply chain manager, Purchasing/commodity manager, Senior buyer(s), Senior and junior planners, Purchasing clerk/junior buyer, Expediter, Master scheduler/planner, Warehouse manager, Shipping/receiving/inspection clerk, Manufacturing clerk

III. EMS Engineering (quality, test, process): Process engineering manager, Process engineer, Process engineering technician, Test engineering manager, Test engineer, Test engineering technician, Quality manager, Supplier quality engineer, Quality engineer

IV. EMS Manufacturing: Operations manager, Manufacturing manager, Manufacturing supervisor , Manufacturing lead, Manufacturing quality auditor, Manufacturing material handler

V. EMS Program Management: Director of programs, Senior program manager, Program manager, Program manager, Program manager, Associate program manager, Quotes supervisor, ECO

VI. EMS Finance: Controller, General accounting manager, Accounts receivable manager/clerk, Account payable manager/clerk, Financial analyst, Cost accountant, Accounts receivable clerk

You can see how the combined savings from managing IDL accuracy, timeliness, and productivity in companies like Flex and Jabil…for the above roles can be considerable.

RELATED

Artificial intelligence exceeding EMS manufacturing industry expectations

Multiply these savings as a result of reducing IDL errors and driving IDL efficiencies for larger contract electronics providers with multiple factories around the world and employing tens of, even hundreds of, thousands in their IDL workforce and you quickly see how Sanmina’s claim of $50,000 in savings is myopic.

OEMs are not bashful about asking for ISO certificates

and digging into process and coordination so asking about

costly IDL workers & workflows should be no different.

And the next time your EMS provider complains about your asking for cost reductions, or they want to re-negotiate your pricing, ask them to fill out our manufacturing supplier questionnaire to help you better understand how carefully they are managing their IDL workers and costly IDL workflows. OEMs are not bashful about asking for ISO certificates and digging into process and coordination so this should be no different. There’s real money to be saved.

MES Big bark, little bite

EMS providers today claim superior, differentiating tools for managing your OEM programs and driving down best BOM pricing and EMS program manufacturing costs, but the reality is each of the EMS providers below either have a platform (or dashboard) built in-house with either old technology, or frankenware comprised of incomplete technology stacks held together by third party vendors who have licensing deals with other vendors that actually own the IP responsible for your success.

EMS providers with no clear, effective IDL management strategy for driving down costs are mopping the floor with the faucet running.

To this point Sanmina claims its MES platform saves $50,000 per week by minimizing components shortages where MES = manufacturing operations = DL, and P,P&E = OpEx/CapEx, and any percentage increase in CapEx (from MES) will have a ROI increase by a factor of ‘x’.

The problem I see here is the savings above should be baked into the quote/contract/pricing.

And questions remain numerous for Sanmina:

- How many people were hired, or not hired to achieve the claimed savings?

- How were the lines of equipment adjusted accordingly based on revised worker requirements?

- Which line operators have been trained with skills to overlap with the (other) equipment?

I can guess Sanmina’s production headcount on the production floor map the Company provided in their article to justify their claim, since I’ve set up EMS corporate strategy in the U.S. and Asia, and I have managed EMS divisions with responsibility for P&L, balance sheet and cash flow statements.

I can also assume Sanmina’s KPIs. But I cannot figure out how Sanmina arrived at $50,000 per week savings.

And regarding Sanmina’s 25,000+ pieces of equipment being connected in the cloud, all this does is inform production a line or piece of equipment is on, or off.

Suppose I’m Sanmina’s customer. Why should I care about their MES offering?

Let’s assume Sanmina’s oldest piece of equipment is 10 years old. Legacy equipment requires some cost of integration. Older equipment has less data to provide v. new equipment. So how many of Sanmina’s 25,000+ pieces of equipment are at a mature age and do not offer much in terms of real data value?

I am not discounting the value MES played and is playing in the majority of EMS tier-1, -2, and -3s. But it remains to be seen where the claim has benefitted in value to the OEM in their MCOGs.

Let’s say Sanmina pulls data every second. Does Sanmina call this IIoT? This is just Sanmina being tech savvy. But does this give Sanmina’s equipment the ability to communicate with other pieces of equipment by sending data? There are 10s of methods and protocols for doing so.

Commonly, the equipment vendor offers a control, or interface, which, when using more of their product ‘ecosystem’, gives shop floor visibility. This can then feed into more command-level systems or analytics for factory management to keep a watchful eye on how well WIP is doing.

Are Sanmina’s machines self-aware or are their machines simply state-enabled-engines telling Sanmina what’s wrong: informing management the equipment light is either on or off. Zero or one, indicating the machine is running or not running.

Sanmina MES tells me the machine is off so I can run and fix it fast but does the machine tell me which component is missing, or incorrect? MES can (or could) report on inventory status, types of inventory pulled, but is Sanmina MES set up this way?

Can Sanmina’s cloud system automatically get the vendor on site if the machine is broken?

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Which brings me to Sanmina’s cost analysis for justifying spend for their MES built internally by colleagues who have to work together and likely never beat up one another because they have to work side-by-side, daily. This is in contrast to when you have an outside vendor sell you something — you get real specificity.

If you take a common RFP for a system integrator from any

OEM or EMS provider, you would likely have a checklist

that internal functional departments cannot check.

And for this reason alone, even without answers to some of the other questions above, I can only assume Sanmina’s MES is not very effective. And I’m most curious to see how Sanmina pitched the MES budget to get it approved.

What is the reverse engineering to the $50,000 savings claim, and can Sanmina break this down into what is this equivalent in headcount/workers?

Sanmina MES solution 42C

Sanmina’s MES digital offering is a great idea but 42C is built by EMS industry-insiders with little to no external leadership how to bring something to market.

EMS provider executives are notorious for habitual thinking and venturing only so far as they are comfortable doing so.

Plus, 42C is narrowly DL-focused, leaving an enormous amount of cash tied up across various functional departments.

A recent survey of 677 corporate strategy executives by CB Insights reveals corporations say they care about innovation, but focus more on continuous innovation instead of new products and services.

And from what I’ve been able to learn it appears Sanmina also chose the wrong base framework, thus creating a bigger technology problem.

Is the 42C more than a hub for the existing equipment provider’s telemetry, or an interface to see the status of the equipment? Often is the case internal technology staffers are limited to latitude on bespoke software development. As a result, they are forced to leverage existing relationships and aged ‘guidelines’ so you tend to see non-paralyzed, license-burdened solutions that do not cope well against common, independent and open, agnostic modern platforms. Internal teams and final products don’t have the same scrutiny where failover and fail safe conditions are required.

SEE ALSO

Effective RFQ for EMS manufacturing programs

Differences between OEM, CM, CEM, ECM, EMS, ODM, JDM, design houses

Broken down they tend to be smoke screens for cost allocation and marketing puffery.

Real MES digitizes manufacturing for tracking and documenting flow of raw materials into finished goods with the goal to help ensure manufacturing operations execution while improving production throughput.

To Sanmina’s defense, EMS providers who automate materials and equipment tracking, production planning and programs scheduling with MES combined with a real-time manufacturing operations management (MOM) system can see big improvements. So why does Sanmina only parade $50,000 per week savings.

The real savings is in managing indirect labor performance (accuracy, timeliness, productivity execution).

Sanmina, and other EMS providers, talk about Six Sigma, 5S methodology, kanbans, lean and ISO qualifications but none of these capture real IDL savings based on improved IDL workflow accuracy, timeliness and productivity execution.

Even combining A.I. with MES, (and/or MOM) and then tying this to legacy ERP systems is still only a half-baked solution, touching only material buyers and handlers, scheduling, manufacturing equipment, and direct labor.

Real A.I. can do far more for helping Sanmina customers than MES ever will.

OEM customers paying for contract electronics solutions should be asking their EMS partners:

What are you doing to effectively manage accuracy and productivity and accountability across each of your IDL functional departments supporting my program?

Many assumptions can be made, and usually are the case, with internal software development v. external solutions. If you take a common RFP for a system integrator from any OEM or EMS provider you would likely have a checklist that internal functional departments could not likely check. And holding the fire to the feet of others is because you are paying for expertise and, therefore, you want to be certain to get it. Every penny.

In your search results, you will be able to further target provider options by choosing End Markets and/or other Services.

Effective MES takes critical thinking and hard work but the EMS industry is not known for creative problem solvers. Hence, comfort zone thinking prevails.

More EMS provider (mis)adventures in MES

Similar to Sanmina, Celestica is another tier-1 EMS provider claiming a custom and proprietary MES solution. I wanted to reach out to Celestica SVP/CIO Mary Gendron, attributed to Celestica’s most recent mention of MES and who reported directly to Celestica’s CEO to learn more about their MES capabilities, whether their solution relies on outside vendors and external IP holders…but Gendron left Celestica late 2014.

Celestica has since not filled the CIO role. This is odd for a publicly traded technology company their size.

Moving on to smaller EMS providers, Season Group also implemented MES, and they used an outside vendor. So did Victor, NY EMS provider, Redcom EMS.

But despite working with technology, EMS providers, by nature, invest only in new technologies when pressed by customers, or winning new business is dependent on new technology acquisition. IDL inefficiency remains in EMS provider workflows, built into EMS provider customer pricing and OEMs are paying for it.

Where Sanmina positions their MES as the answer to driving OEM customer savings, Sanmina, like other EMS providers, leaves big money on the table in raw materials inventory not yet classified as WIP with 2x to 4x materials value on their books.

Add to the MES software trend, Creation Technologies also claims a proprietary manufacturing execution system on their website but Creation does not disclose whether they built theirs in-house or the MES is vendor-provided.

Spain-based EMS provider IKOR is another claiming MES differentiation. IKOR is combining an SAP ERP system with a vendor-provided MES. But even this won’t free up working capital tied to IDL inefficiencies plaguing every EMS provider today.

Bitron Industrie also claims a ‘proprietary’ MES, and so does European provider Enics.

Enics is using SAP with SAP ME (SAP manufacturing execution). One major problem wth this is SAP does not own the entire IP stack Enics is paying for, thus leaving Enics and their customers exposed.

And despite claims by Enics, “…deployment of this innovative SAP SCM technology plus SAP manufacturing execution (SAP ME) to boost our efficiency and transparency means that we can now face the future in confidence”, only reveals little understanding where the majority of Enics’ working capital remains tied up.

The list of EMS providers using MES vendors with incomplete technology stacks, and potentially exposing their customers to considerable risk that can surface any time goes on.

Supply chain optimization: Flex v. Jabil

Looking at tier-1s Flex and Jabil, Flex appears to have more knowledge on technicality and their management might be more open to outside influence, enhancing willingness to move outside their comfort zone and likely able to combat myopic thinking prevalent in EMS.

I reached out to Jabil’s Gary Cantrell, CIO/SVP information technology, wanting his feedback on Jabil’s supply chain software offering, and its reliance on Microsoft-owned IP but did not hear back by the time this article published.

EMS providers are constantly on the hunt to add additional revenue streams but Jabil is not a software innovator, and taking their offering to market on top of licensed products from SAP and Microsoft without a software integration innovator is destined for being second-rate.

I also feel Jabil’s software solution is a distraction from Jabil’s core, operational principles.

Ultimately the market will decide on Jabil’s supply chain software but its been nearly two years since Jabil’s software launch and I’ve not heard one word from any OEMs we know working with the Company who have spoken to benefits directly tied to Jabil’s supply chain software.

Flex’s platform uses its own IP and chose to focus on supply chain logistics. Jabil chose to focus on supply chain analytics.

My opinion is Flex is ahead of Jabil when it comes to helping OEM customers optimize their supply chains.

But Flex is not using A.I. either, beyond mention of A.I. in blog posts on their site.

So, I reached out to Flex CIO & SVP information technology/systems Gus Shahin, but Gus wanted my questions in advance and he also wanted marketing to get involved.

Flex took a serious leap into supply chain visibility tools previously with Elementum, which it recently spun out, but having talked off record with software devs who worked on Elementum its capabilities remain to be seen.

Not one to give up, Flex also recently ventured into automating manufacturing and A.I. with a minority stake in AutoLab founded by a former Flex executive, and where Flex CEO, Mike McNamara also serves as director.

As a decentralizing technology A.I. will alter the way manufacturers work, creating more efficient and cost-effective supply chains as a result and EMS providers with A.I. will have opportunity for better operating margins and better ROE/ROA.

Manufacturers with A.I. will reward shareholders sooner.

A.I. and manufacturing automation

Today, two things are certain in the race to create more manufacturing value through automated lights out manufacturing and artificial intelligence: lights-out manufacturing is not yet here, and manufacturing A.I. solutions can identify IDL waste and reduce IDL costs while streamlining workflows and drive considerable improvements in manufacturing ROA/ROE, and stakeholder returns.

The hardest place for EMS providers to address and adjust cost is in their own cost centers – IDL functional group employees and A.I. elevates and informs EMS management to more effective ways of managing business workflows and freeing up working capital, reducing MCOGs, and more.

OEMs reading this should demand EMS providers clamp down on runway costs. There is yet to be a breakout EMS provider with A.I. and this betrayal to the humanity of EMS providers claiming they are acting in the best interest of their OEM customers will cost many EMS executives and their shareholders.

Sanmina’s article ended with, “there are some very forward thinking manufacturing organizations who have made investments over the past four or five years, transforming their operations into smart, digital factories with superior supply chain predictability, agility, and visibility.”

I understand the EMS supply chain and I’ve talked with EMS providers worldwide about their factories and functional support teams and despite Sanmina’s claim, there is no EMS provider today who has yet been able to claim superior supply chain predictability, agility, and visibility because no EMS provider has yet to implement A.I..

Mark Zetter is founder at Venture Outsource. Learn more here and here.

Sources

EMS industry research, EMS company reports, and EMS industry provider websites accessed online February 2018 through May 2018.

“Jabil Enters Supply-Chain Software Business”, Loretta Chou, Wall Street Journal, October 25, 2016

“FLEX: Emphasizing Supply Chain Solutions Provider, Evolved Past “EMS””, Sean K.F. Hannan, Needham & Company, LLC, March 10, 2016

2017 Industry 4.0 Survey, “Industry 4.0: hype or reality? The current state of play in Flemish manufacturing”, Peter Vermeire, Johan Van der Straeten, PwC

“How Industry 4.0 & IIoT Impact Supply Chain Management: Hype vs. Reality”, Sanmina, (PDF) July 2017

“Industry 4.0 Revolutionizing the Manufacturing Industry – 2018”, January 2018, CrispIdea Research

“Blockchain In The Supply Chain, Transforming Global Trade”, Stephaine Price, Varun Choyah, CIBC, April 8, 2018

“Disruptive technologies, The quest to find the next game-changers”, Steven Pelayo, Angus Lin, HSBC Global Research Team, HSBC, April 2018

“State of Innovation Report, Survey of 677 Corporate Strategy Executives”, CB Insights, May 2018

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.