China is the world’s largest country consumer of industrial robots. According to Robotics Business Review, in two years there will be more industrial robots in China than either the EU or North America. China also reveals a rising trend in the annual sales of passenger car sales.

A recent report by investment bank Deutsche Bank highlights some of these emerging trends. Correlations can be made between electronics industrial robotics / manufacturing automation and automotive electronics, whether the technology is for building robotics(e.g., embedded computing, industrial PCs …) and / or use within transportation vehicles (e.g., advanced driver assistance systems (ADAD), advanced motor controls …).

Multipurpose industrial robots per 10,000 employees in manufacturing industry (2012)

Rising regional costs in Asia and China in particular, add to the secular demand case for automation in Asia / China. A rising Asian automation demand is anticipated according to the calendar Q1 2015 report by investment bank Deutsche Bank.

Global available market for auto manufacturing automation

Whether the topic of discussion is robotics and automated manufacturing capabilities building cars and transportation vehicles or, the topic focuses on automotive electronics under the hood and inside cars and the ‘connected vehicle’, the U.S. Department of Transportation estimates in the United States alone, the distance traveled each year by motor vehicles to be more than four trillion miles which translates to a lot of time spent inside cars by Americans.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Spending a considerable amount of time in cars, automotive OEMs want to make that experience as enjoyable as possible for drivers and passengers. And in China the trend seen toward driving passenger vehicles does not appear to be slowing down anytime soon.

China annual passenger car sales

Electronics OEM company needs for lowering manufacturing costs and the contract electronics manufacturing (CEM) industry are encouraged to keep an eye on relationships between these markets. Readers can also refer to this earlier interview with former Delphi chief technologist Andrew Brown Jr., Ph.D.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Worldwide Automotive Segment Revenue Forecast, ($B), 2008-2019

Contract Electronics Automotive Electronics Market Sector 2014 – 2019 CAGR

EMS Sector 10%

ODM Sector 10%

Total 10%

Automotive Electronics 2014 Share

EMS Sector 76%

ODM Sector 24%

Automotive Electronics 2019 Share

EMS Sector 76%

ODM Sector 24%

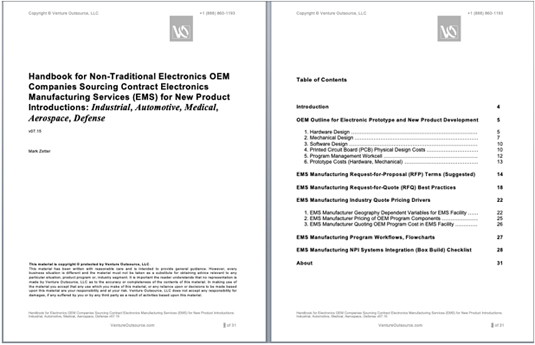

Industrial Electronics New Product Launch and NPI Management

Learn more about industrial electronics new product NPI program launch and cost management in our 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide industrial electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.