WISTRON’S LACKLUSTER PERFORMANCE for 2Q11 reveals the ODM’s reporting of net income for the quarter was largely a non-event according to a recent industry report. It would appear Wall Street has given up on Wistron for 2011 and is looking for better results in 2012 for the Company which counts Dell; Acer, Lenovo, IBM and Sony as key customers.

The report prepared by investment bank J.P. Morgan basically indicates the bank feels 2011 to clearly be a transition year for Wistron and the Company should fare better from Wall Street’s perspective in 2012 on the back of a strong pipeline from RFQs the banks feels are mostly already completed.

In the report, Wistron maintains notebook shipments at 30+ million for the year, but the Company revised handset shipments downward from 10 – 12 million handsets to a shipment of 9 million and, LCD TVs from 10 million down to 8 – 9 million.

Wistron also lowered its capital expenditures figure from US $700 million to US $500 million.

2012 continues to fuel hope

For 2012 growth the report states Wistron expects:

- Ultrabook and Win 8 to revive notebook growth in 2012

- New TV segment customers to offset the decline from old customers. Both emerging and developed countries will be Wistron’s target market for the TV segment. Plus, there is the LCM factory / vertical integration investment in Zhong Shan to improve performance and cost competitiveness of the TV segment.

- Multiple opportunities in Wistron’s cloud business – though Wistron admits potential channel conflicts and thus feels revenue could still be small in the interim as the Company would need to separate resources.

The report continues by stating Wistron margin has bottomed out from the low of 1Q11, but 2H11 margin guidance is flat H/H, owing to rising costs on depreciation and headcounts.

The bank feels Wistron management’s conservatism is due to uncertainty with high margin business like Sony / RIM, though it feels Wistron’s notebook margin is on the uptrend and RIM business could (possibly) return to normal.

The report quotes Wistron management in stating Company executives believe margins will rise in 2012, on the back of:

- Less price competition overall with (hopefully) falling material costs

- Better margin in Wistron’s cloud business. Wistron sees multiple chances in the cloud-computing business, and the report mentions Wistron will prioritize the safety of customers’ data to attract more new customers while keeping old ones. Revenue contribution from cloud computing is not expected to be big in 2H11 and 2012 but the cloud might be a sector that can improve overall margin for the Company.

- Better cost down potential on stabilizing wages plus Wistron confidently expects to switch its rising R&D expenses to its customers in the future once new and popular products attract end demand.

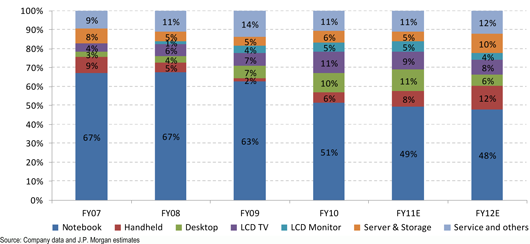

Wistron revenue mix

Wistron gross profit mix

Product category guidance and business outlook

In the report, Wistron feels notebook shipments will have single-digit quarter-on-quarter growth for both Q3 and Q4, and the Company feels confident to reach its 2011 shipment target of 30 million notebooks.

Looking at Wistron’s tablet business, Wistron expects to ship one million tablets for 2011 and more than three million tablets in 2012, all of which will be non-Apple tablets.

Margin for Wistron’s notebook business in 2H11 is expected to be better than 1H11, and so is margin year-on-year growth in 2012 than in 2011 mainly due to the notebook price-cutting game is not severe now compared to last year and, Wistron is begining to see stabilization in wages in 2H11 and 2012. The report also states Wistron will start to ask for price discounts from its supplier base given the recent slow down in material price hikes with the potential cost downs most likely happening in Q4.

Wistron disclosed during its quarterly financials release the Company does not see a big share coming from its Ultrabook business this year but the Company does expect its Ultrabook business to ramp up next year and it should be a key driver for 2012 growth. That said, 10% to 20% of Wistron’s 2H11 notebook shipment is expected to come from Ultrabook.

Furthermore, Wistron did state it can produce Ultrabook products with a price less than US $1000 by changing some specs such as unit screen size. Additionally, Wistron has a relatively positive outlook for Win8 and its ARM-based versions for the company believes new products can help Wistron to provide more useful weapons to its customers while also creating end demand.

Meanwhile, Wistron has invested in after-sales centers in China and Brazil and is seeing some progress in this field of the supply chain. Although there might be some delays in contract signing in 2H11 caused by logistics difficulties, Wistron believes in 2012 all contracts can be signed normally.

However, what all of this means for Wistron in 2012 remains to be seen.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.