EVERY US STATE has lost manufacturing jobs in some fashion to cheaper, low-cost manufacturing alternatives overseas. To curb this manufacturing job loss tendency and to attract, and retain, manufacturing functions in the United States, it’s time to refine what could, again, support and encourage organizations to open manufacturing facilities in the States. (Read US Chamber president / CEO Tom Donohue comments on outsourcing and offshoring)

To start, it begins with leveling the playing field.

Global events at play

Simply as a means to stay competitive in the global marketplace, many companies have been forced to cut costs to maintain some measure of profitability.

In weighing these cost-cutting measures, the prospect of outsourcing jobs offshore and overseas to take advantage of the cheaper labor in places like China or India, in addition to the growing market opportunities in these regions, has become an attractive alternative for corporate executives.

Automation is also a large culprit to the declining US manufacturing workforce base. However, even perceived competitive advantages in labor costs doesn’t always equate to job stability.

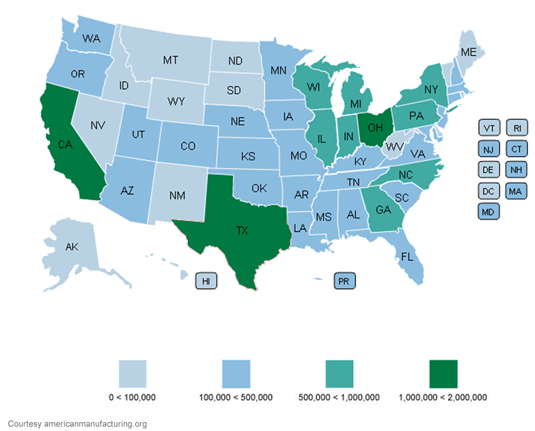

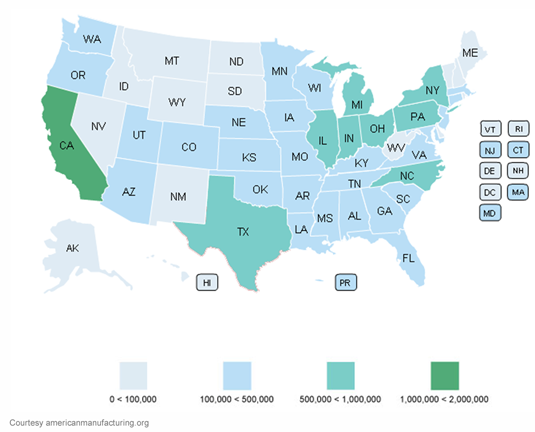

AmericanMaufacturing.org illustrated the path of American manufacturing as we know it from a starting point of 2000 for comparative purposes.

American manufacturing jobs by state, 2000

American manufacturing jobs by state, 2008

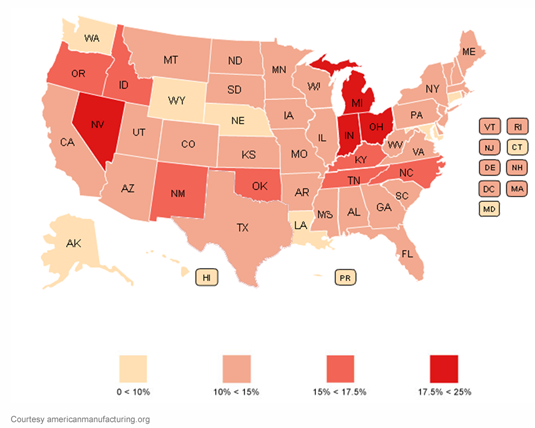

The jobs lost as evidenced in the map below paint an even more profound perspective.

American Manufacturing jobs lost, 2008 – 2009

Identifying building blocks

In looking at the manufacturing marketplace in the United States, an interesting case study is the automotive manufacturing industry.

Over the past 10 years, much of the new investment in the automotive sector has been tied to the southeastern region of the US instead of the Midwestern states of yesteryear.

A central theme associated with this change can be traced to the surge in population growth that the South experienced over the past decade relative to other conventional manufacturing locations.

Over the past 10 years, the South was the fastest growing region, growing by 14.3 million people.

The West grew by 8.7 million people while the Midwest and the Northeast lagged further behind at 2.5 and 1.7 million in growth, respectively.1

In addition to this population shift, cheaper labor rates, less unionized workforces, and competitive incentive packages (to name a few) have also been key factors in chronicling the rise of southern automotive plants.

Acknowledging the trend

With the role globalization has played in the contract electronics manufacturing services (EMS) market where products can be designed, manufactured and assembled all in different countries, it’s important to consider what this means for re-shoring the US contract manufacturing.

The answer for this challenge is multi-faceted and dependent upon many different company-specific criteria.

For those companies that are looking to right-size their supply chains and correct any quality control issues that may be affecting their operations by virtue of off shoring jobs, being aware of important considerations such as the population shift in the US is extremely valuable.

Perhaps more importantly, this shift and subsequent rise in large-scale automotive plants also implies that the manufacturing intellectual capital is no longer confined to traditional towns or cities known almost synonymously with the trade.

In the economic development world, manufacturing tends to be the buzz word in industry that many communities actively pursue.

Because of the multiplier effect of jobs related to manufacturing operations is so high, many communities understand, and are therefore willing to offer up, more aggressive incentives to lure these projects.

Depending on the size and scope of the project, these incentives can offer a certain degree of risk avoidance in establishing a manufacturing operation as the performance-based partnership with the community to generate jobs and increase the tax base becomes a joint investment.

If there are candidates for re-shoring manufacturing jobs in the US, following the path of the US automotive manufacturing market seems to offer a strong value proposition for success.

1. Source: http://www.reuters.com/article/2011/03/25/us-census-regions-idUSTRE72O02X20110325. South rises again, leading US in population growth. Goldberg, Barbara: 2011

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.