INTEREST IN SUPPLY CHAINS and supply chain careers is increasing as are salaries. A survey earlier this year by the Institute for Supply Chain Management reveals the average salary for supply chain management professionals is $103,664. This is up from $98,200 a year earlier.

Whether your company sells coffee or iPhones, your supply chain can become a competitive differentiator. This holds true for companies in all industries. Leadership focus on operational improvements and supply chain management is gaining more attention in boardrooms across the globe as companies are now competing supply chain v. supply chain.

VentureOutsource.com talks with Gene Tyworth, Ph.D., chairman for the department of supply chain and information systems (SC&IS) at Penn State Smeal College of Business. (www.smeal.psu.edu) Dr. Tyworth has led Penn State’s SC&IS program since its inception in 2002.

Smeal was recently ranked by Gartner as having the No. 1 undergraduate and graduate programs in the U.S. for supply chain management. With 30 full time faculty, 800 resident undergraduate students, and 50 resident graduate degree students, the program is one of the largest in world.

In this exclusive interview, read what Dr. Tyworth has to say about skill gaps in today’s supply chain managers; important knowledge areas tomorrow’s supply chain leaders must focus on, why improved supply chain optimization isn’t just about maximizing (or minimizing) various components of your company’s supply chain, plus more.

Connect directly with Dr. Tyworth and other academicians, electronics industry executives and managers, analysts and engineers plus other global supply chain operations professionals and various government officials in VO GlobalNet Professional Community.

Transcripts from that discussion follow…

VentureOutsource.com: What are some of the skill gaps you see in supply chain management professional development?

Dr. Tyworth: I’m thinking primarily about the tech sector, but I would say, in general, there are two overall trends that most knowledgeable observers would identify.

One is the complexity of supply chain is growing dramatically and the usual suspects for that are globalization, multiple parties, the risks imposed when you have supply lines that stretch across the globe, and of course, there are technologies in green issues.

A second major overarching trend would be the rising status and expectations from top management about the effectiveness of supply chain management and its importance to their organization.

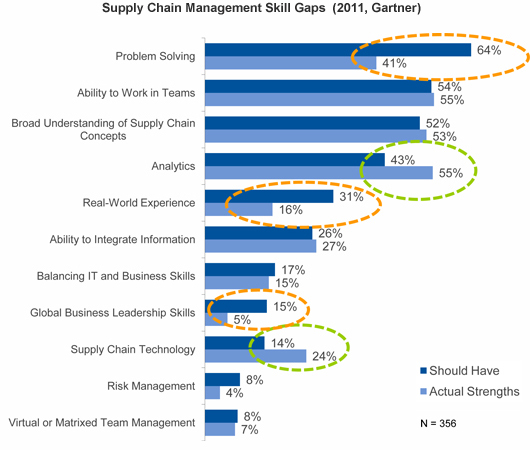

So with that, I characterize skill gaps into two categories. One would be looking at entry-level management, which the Gartner report that came out this year addressed. The other is problem solving, but I’m not sure that it’s what we normally think of in problem solving because in the same list, it showed ‘improvements in the skill set with analytics’.

So I don’t think it’s technical capabilities to solve problems; rather, it’s entry-level folks in management having difficulty articulating what problems are.

That’s probably a function of, or depends on, the inability to articulate problems, is a lack of a cross-functional perspective, a lack of the end-to-end process perspective.

So you may be pretty well educated or have some skills and experience in one area of supply chain management, but not have too much of an appreciation across others.

I would also say that it may be, potentially, a limitation of a survey instrument in that there’s no distinction between managers coming out of engineering schools and entry-level managers coming out of business schools.

One would expect the engineers to be technically proficient in problem solving, but perhaps have a far more limited cross-functional perspective, and vice versa for the business students.

So this may be something that could be teased out in future surveys.

Besides problem solving, a second area that pops up is real world experience. This would be speaking to internships, perhaps other kinds of things, case competitions, doing some kind of applied fieldwork under the supervision of faculty, and so forth.

Global leadership and team skills, working in virtual teams across continents and across the world in global supply chains, international exposure, study abroad kinds of things are areas that need to be strengthened.

And finally, risk management, which, obviously, everybody’s attuned to with the earthquake and resulting tsunami situation in Japan, dislocations, disruptions from political turmoil and natural events and other kinds of catastrophes, as well as the usual kinds of things that we haven’t seen too much recently, like strikes, capacity shortages, maybe from fuel, high fuel costs, labor, as in the trucking industry where you have driver shortages and so forth.

So risk management at both the strategic level, as well as the operational level is getting a lot of attention.

VentureOutsource.com: What should companies look for when hiring senior supply chain managers and executives?

Dr. Tyworth: From what I’ve read and studied, the essential skills that need to be strengthened are in the planned process/change management. Nothing really surprising there.

But what’s interesting is the strengthening knowledge and source, the strategic procurement, and the deliver process, which would be the logistics; customer service, interface with customers after sales — these processes are rated high on the list of essential skills: performance, and customer management, and technology enablement.

It appears that, at the top level, strategic planning, risk management, change management, source, and deliver, but not manufacturing. That’s substantially less.

And then all the issues with customers, order fulfillment, demand fulfillment, I would say sales and operations planning kinds of things come under customer management, and again, technology enablement.

So having not only the skills to understand or appreciate the importance of technology, but the ability to process engineer so you’re throwing technology at otherwise bad processes or dysfunctional processes.

The ability to understand and apply is referred to as process engineering.

Don’t throw technology at processes that are not very effective and have a lot of useless steps in them. It’s not going to really solve the problem or make a bad process work.

Don’t take something that’s broken and try to fix it with technology.

VentureOutsource.com: What should companies look for when hiring third-party supply chain operation companies or individual experts for systems?

Dr. Tyworth: A lot of the attributes we just talked about are also going to apply if you’re going to work with a third party, but I think there’s some foundation questions or issues that need to be considered from the hiring company’s standpoint. You have to have a clear understanding of your needs, a needs assessment, what’s on the table.

And to the extent you’re going to work with a consultant or a third-party logistics firm, you need to have as much granularity and clear articulation of what these needs are and what’s core for you. And, what isn’t.

Otherwise, you have the classic case of when you do bids.

You have a lot of uncertainty surrounding what you’re requirements are, and that’s going to force bidders to inflate bids to anticipate what they’re not sure about in order to cover their costs and provide those services.

So, to a large extent, the answer is going to depend on whether you have a handle on what you want and you articulate your critical trade lane attributes, what are your customer service targets, what are your product attributes.

Some of this is pretty pedestrian and boils down to packaging, units per package.

To the extent you can articulate this, third-party firms can come up with some interesting and innovative ways to make it more efficient and to improve the processes.

If it’s pretty vague, then maybe you’re going to have one of the failed partnerships out there.

Is it a management where they’re providing intellectual capital and technical and managerial functions, or is it asset-based? Are they going to be integrated into your system? These questions have to be addressed.

Then the usual list includes capabilities; scope of services, geographical coverage, technology, green, capacity and flexibility to respond to risk management.

One that sometimes doesn’t show up is financial conditions.

You don’t want these people having your products and then going bust, financially, and holding your goods as collateral, or not delivering them. There’s also cultural fit, confidentially, trust…And, that works both ways.

Some ethically challenged hiring companies will put out bids, get a solution from a third-party provider, use it for a year, and then just take that intellectual property and knowledge and apply it internally.

There are war stories like that out there. I don’t know how widespread it is, but trust is, obviously two ways.

VentureOutsource.com: Let’s talk about supply chain prioritization inside organizations. How do brand marketing companies, such as Starbucks, P&G, HP or Cisco develop or prioritize supply chain principles in their organizations?

Dr. Tyworth: I’ve had opportunities to visit and meet with supply chain leadership and executive leadership at Starbucks. In their case, prioritizing their supply chain focus was driven out of necessity when the market went south for Starbucks and they needed to get things turned around.

So while Starbucks is a brand company and a market-driven company, it turns out that logistics and supply chain are huge parts of their success story of turnaround.

In Starbucks’ case, out of necessity, they came across this and they’ve done a fantastic job in a relatively short period of time getting up to speed to the point where they were selected as a top 25 best company in supply chain by Gartner this year.

I think other companies, like Proctor & Gamble have been good at this for years, although I think you could characterize them as having marketing and brand management as their primary core competency.

They are excellent, like Kraft and others in their industry sector, at efficient and effectiveness in applying supply chain. It’s a part of the culture.

The top management recognizes this as an important area. It’s not some back room thing.

It’s not something just viewed as a cost-occurring necessity to cut costs. It adds to the top line. And, they’ve organized and implemented and hired to achieve excellence in the area of supply chain operations.

VentureOutsource.com: What are some of the long-standing problems you see supply chain companies exhibiting with what they say they can do versus what they’re actually capable of doing?

Dr. Tyworth: At the top of my list… Even some of the most sophisticated and widely recognized companies in supply chain management have silos.

The term silo has been around for decades, but the problem still persists — metrics that are function-specific instead of process-specific, and by this I mean supply chain process cuts across procurement; cuts across manufacturing, and it cuts across the logistics, deliver and fulfillment.

The metrics need to be focused at the end point. Have you delivered? Is it fulfilled?

It’s not whether your transportation costs or inventory level has gone up or down. Those have to be coordinated to the point where you’re focusing on the end result, not on any particular function because the inherent nature of supply chain management is cost and service tradeoffs.

You need an integrated perspective, an end-to-end perspective today, for lack of a better term, a process manager that can say:

All right. We’ll spend more on air freight to reduce inventory, or we’ll ship to ocean freight and we’ll increase inventory.

The customer gets the product fulfilled in the targets we set and when we add up the costs and we consider all the risks, we’re at the best we can do.

And by this I mean you’re keeping your service targets at the lowest overall cost. The system cost.

By the way, for an old-timer like me, the whole origins of business logistics goes back to the ‘60s.

The fundamental difference today is sophistication brought about by technology enablement and the organizational realignment for supply chain management.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.