If two contract electronics providers send their sales people to pitch an OEM prospect. One wears a set of coveralls the other a nice clean suit. Who is the customer going to choose? The loud, forward-charging sales person trying to convince you to buy services, or the sophisticated enabler with knowledge-ready answers to questions about your biggest OEM product or service challenges?

Awareness of the Internet of Things (IoT) has been gaining ground in contract electronics circles. Some service providers speak to segments of the IoT and its opportunities and technologies on their Websites.

But most provider sites purporting the provider has an understanding of IoT leave me yawning. For a while Jabil was leading the charge with their Blue Sky Innovation facility in San Jose, CA.

Jabil best positioned itself early on (online and off) to address what the IoT can and will offer electronics OEM seeking more innovative ways to do more with their products and services.

Foxconn has done next to zero with online marketing its IoT capabilities but the world’s largest electronics manufacturing services (EMS) provider publicly committed finances in IoT to technical capabilities provided by a French Internet of Things and cloud solutions provider. The Google Trends graph below displays trending information for the Internet of Things.

Until other contract electronics services companies understand what ‘real’ differentiation means, opportunities the IoT can present providers of EMS and ODM services might always be that goal just too far out of reach.

Being able to explain a provider’s differentiation should not be difficult but OEM readers would be surprised, or not, at what we hear from industry. After all, explaining why they’re different or better is one of the factors driving purchasing decisions.

RELATED

Artificial intelligence exceeds contract EMS manufacturing expectations

But recently EMS provider Flextronics re-designed its Website. Far above anything I’ve seen so far, I was amazed no one else has put in the effort they have. Flex(tronics) has quickly distanced itself from all other providers currently positioned for offering IoT service capabilities.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

Flex’s marketers have done a terrific job branding and effectively communicating to OEM prospects the provider understands the evolving IoT horizon. With a gaggle of newly-crowned Flex embedded systems developers, whether Flex can execute remains to be seen.

Most other providers wanting to throw their hat in the ring to market their IoT service capabilities will be hard pressed to build an online presence that will cause Flex to look in its rear view mirror. Read more about comparing Flex, Jabil, Sanmina and Celestica manufacturing supply chains on here.

IoT opportunities and challenges

Advances in embedded computing on faster, smaller platforms offering greater functionality combined with systems connectivity supported by data identification, aggregation and mining is what’s driving the IoT marketplace today.

The vision for the IoT age of machine-to-machine (M2M) connectivity is creating a future where intelligent embedded systems will autonomously communicate with each other, transforming businesses and our lives, without end user inputs.

Growing infrastructure for Internet of Things M2M

Some opportunities for connected platforms include: a) emergence of real-time business model, transforming how we think about and analyze data; b) emerging connectivity standards and M2M platforms will provide technology leaders with real advantages and c) the impact of M2M will spread beyond device ecosystems.

Provided the sleek-suited sales person closes the deal, how effectively electronics providers leverage their IoT positioning of their services is not the only thing they have to worry about.

For absence of doubt, growing revenues is important, but protecting against the sophistication deployed by hackers for highly targeted interdictions and intrusions to infiltrate the most secure supply chain and industrial control systems and enterprise networks is also important.

Questions on the minds of corporate and government decision makers also include staying ahead of the most common and critical vulnerabilities that intruders are using to get into seemingly secured systems.

Can executives in small- and medium-sized (SME) companies disregard security during IoT product design and development? If so, at what cost?

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

What about the Fortune 100 firms or government? Does being a bigger target to blackhats translate to being held less accountable? You may think you’re secure, but breaches at Sony, Target, Google, the Office of Personnel Management and the White House should tell you otherwise. See trending information below for cybersecurity.

Meanwhile, some of the challenges of an M2M world include: a) an explosion of real-time data; b) vertical markets will need to agree on connectivity and platform standards and c) security policies must be robust to protect all levels of data. (View archived research presentation on IoT M2M trends here).

Is it too time-consuming and cost prohibitive to attempt to build secure software and hardware systems? What can be done to harden electronics and systems at pre and post product builds?

Like it or not the IoT has ushered in innovation and automation into today’s businesses and conversations. And despite what some may think, robots displacing workers is no longer important if a company is not competitive. And to be competitive in this new world shaped by the IoT, companies cannot afford to ignore automation due to a lack of tech-sales prowess.

Regardless of savvy marketing, and remove any genuine desires to execute, having access to enough available cash to staff and build IoT service capabilities in-house with deep ETL expertise to extract, transform and load proprietary methodologies to meet IoT and machine learning head on creates a whole different set of challenges.

Industrial Electronics New Product Launch and NPI Management

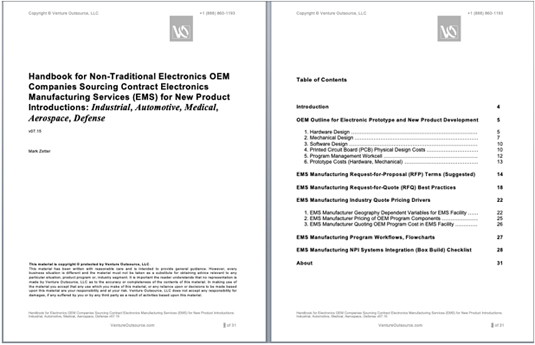

Learn more about industrial electronics new product NPI program launch and cost management with the Venture Outsource 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide industrial electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.